life insurance policy types

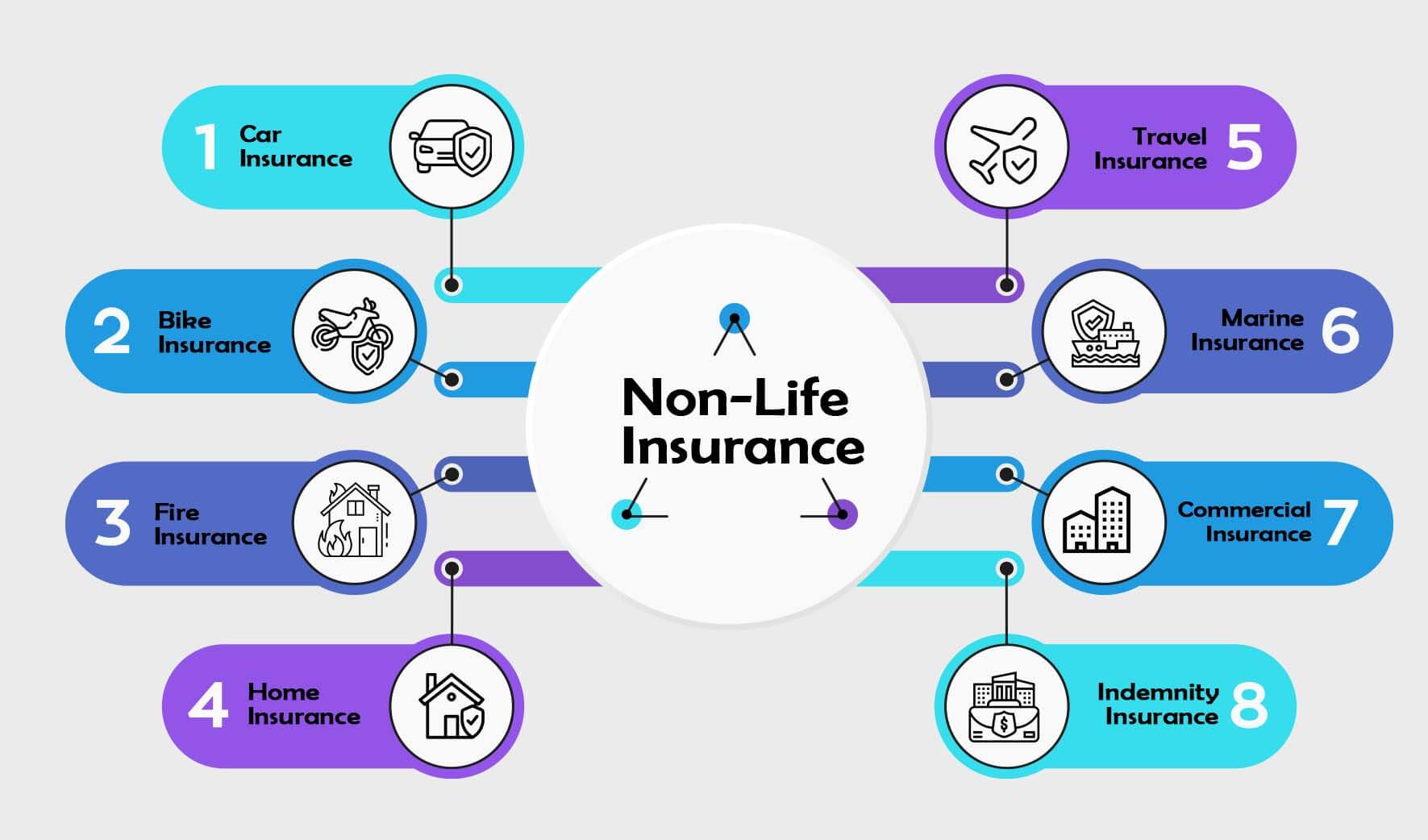

3 What is the difference in life and non-life insurance. Loans taken against a life insurance policy can have adverse effects if not managed properly.

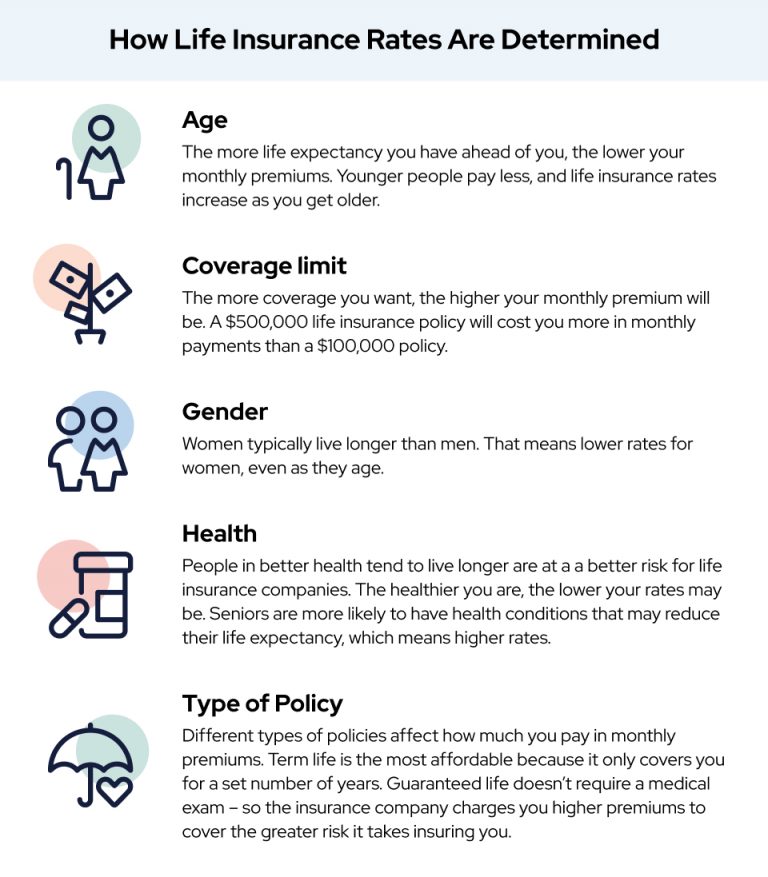

Best Life Insurance For Seniors Free Guide

This savings portion can.

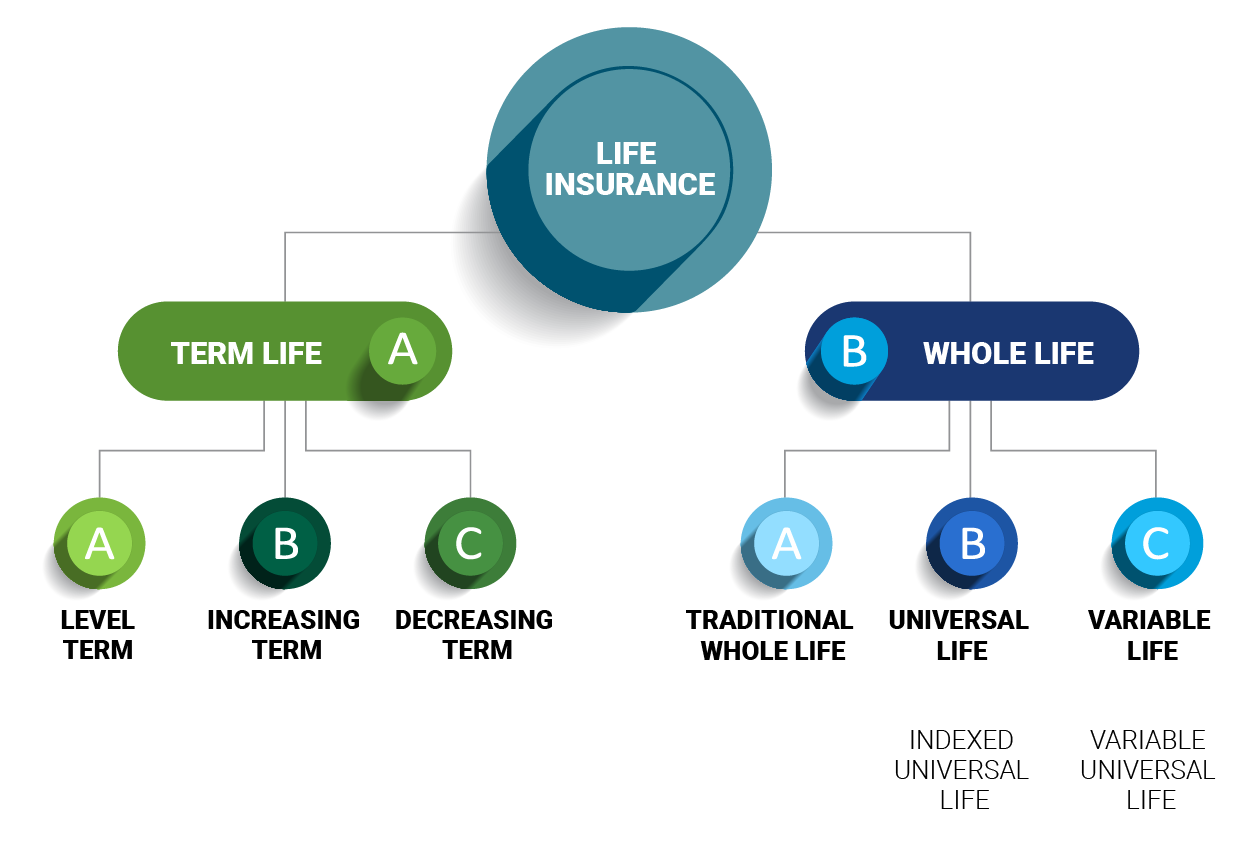

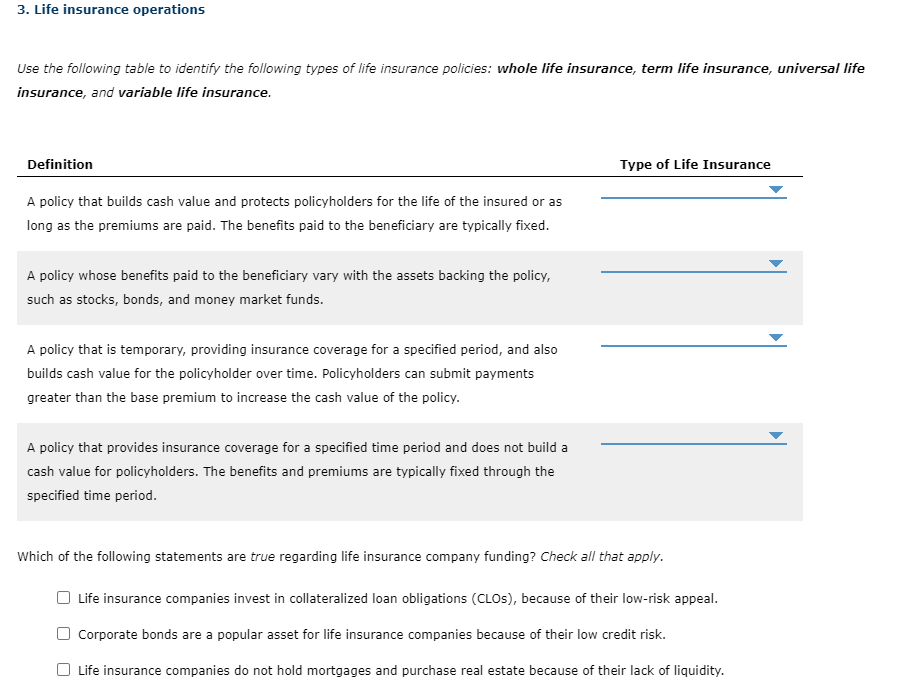

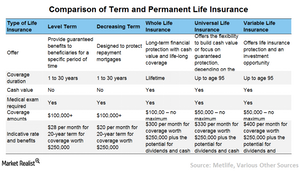

. All of these permanent life insurance types are designed to cover you until your death like Universal Life Insurance or Whole life insurance. If your death occurs during the coverage period of your selected policy the people you specify as beneficiaries will receive benefits from the policy either as a lump sum or through flexible income payment options. Coverage for a specific term or length of time typically between 10 and 30 years.

These are two major types of insurance policies offered in the country. The five types of life insurance riders you can choose from are. What are the types of life insurance riders.

An insurance company that offers general or non-life insurance policy is called a non-life insurance company. It is sometimes called pure life insurance because unlike whole life insurance theres no cash value to the policy. Visit us in person.

Most riders fall into one of five categories. Life insurance is a protection against financial loss that would result from the premature death of an insured. Policy loans and automatic premium loans including any accrued interest must be repaid in cash or from policy values upon policy termination or the death of the insured.

For some categories a standalone insurance policy is often going to offer more coverage than a rider will but some add-ons might be worth the additional cost depending on your needs. Compare different types of life insurance. Find an Investor Center.

Learn to navigate the costs options to cover expenses and insurance policy features. Simply put life insurance is a policy that will provide benefits to your chosen beneficiaries upon your death. A term life policy is exactly what the name implies.

The named beneficiary receives the proceeds and is thereby safeguarded from the. Fidelity insurance products are issued by Fidelity Investments Life Insurance Company FILI 900 Salem Street Smithfield RI 02917. An umbrella term for life insurance plans that do not expire unlike term life insurance and combine a death benefit with a savings portion.

We have many types of life insurance to choose from. Permanent Life Insurance can help provide lifelong protection and can typically provide the ability to accumulate cash value on a tax-deferred basis similar to earned taxable income being deferred. Cash-value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulationWhile variable life whole life and universal life insurance all.

Articles Junction Types Of Life Insurance Policies Life Insurance Definition Meaning

Types Of Life Insurance Policies In India Comparepolicy

Solved 3 Life Insurance Operations Use The Following Table Chegg Com

Types Of Life Insurance Financialplanning

Types Of Life Insurance Policies Easy 2022 Guide Policyme

Types Of Life Insurance Policies Stock Illustration Adobe Stock

Life Insurance Riders Custom Life Insurance Efinancial

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance What It Is How It Works And How To Buy A Policy

How To Pick A Life Insurance Policy

What Are The Different Types Of Life Insurance Part Ii Financial Planning And Stewardship

A Complete Guide To Life Insurance Expensivity

Life Insurance Overview Federal Life

Insurance Com Permanent Life Insurance Helps Protect Your Loved Ones When You Die Read On For Types Of Permanent Life Insurance Policies And When It Makes Sense To Buy One Http Bit Ly 2smfubk

Non Life Insurance Policy Policybachat

Types Of Life Insurance Which Is Right For You Ramsey

Types Of Life Insurance Policies Easy 2022 Guide Policyme

Types Of Life Insurance Md In The Black