block input tax malaysia list

Block input tax malaysia list. Blocked input tax refers to input tax credit that you cannot claim.

Blocked input tax however means input tax credit that business cannot claim.

. Block input tax malaysia list Tuesday November 23. ITC is used for payment of output tax. International tax agreements and tax information sources.

The goods or services are supplied to you or imported by you. On the days when the writers block hits particularly hard. Section 175 of GST Act deals with the blocking of ITC on specified inward supplies.

Block input tax malaysia list Sunday February 20 2022 Edit. International shipping is available for the latest and trendy Korean fashion style. Block Input Tax Malaysia List - Income Tax Fundamentals 2017 with HR Block Premium.

1003041 Block J Jaya One No. The goods or services. You should register an income tax file with the Inland Revenue Board if you.

55 block input vat 60 other taxes 61. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns. Blocked input tax however means input tax credit that business cannot claim.

Input tax incurred can be claimed in respect of the supplies made outside Malaysia which would be taxable supplies if made in Malaysia. Block input tax malaysia list. You can also block or cancel your card by contacting 03-2714 8888 Touch n Go Careline Center 700 am to 1000 pm daily including public holidays.

Input Tax Credit on the cost incurred when manufacturing goods and supplies. Those GST you cant claim is called Blocked Input Tax Credit. RM150000 RM4000 ii The garment manufacturer is entitled to claim input tax since the value of exempt supplies is less than RM5000 per month and does not exceed 5 of the total value of all supplies.

Under GST businesses are allowed to claim GST incurred on purchase of most goods and services. Issues certain instructions with regards to the procedure to be followed for verification of availment of input tax credit rejection of refund. 2 the supply of goods or services relating to.

Another country on our list thats making an effort to be more welcoming to expats is malaysia. You can claim input tax incurred on your purchases only if all the following conditions are met. Those gst you cant claim is called blocked input tax credit.

A specific Sales Tax rate eg. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. 36 period to claim input tax.

030 Malaysian ringgits MYR per litre is applicable. Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive money in return. Inland Revenue Board of Malaysia Non Resident Branch 3rd Floor 6 8 Blok 8 Kompleks Bangunan KerajaaJalan Duta 50600 Kuala Lumpur.

ITC being the backbone of GST and there are many condition to claim ITC on any items. But there are some cases where ITC is blocked so that recipient is not able to claim ITC. Under the gst category businesses are allowed to claim gst incurred on purchase of most goods and services.

List Of Accounting Software Malaysia Accounting Software Best Accounting Software. Corporate tax rate in malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. You dont need to finish creating your app in Xcode before entering its information in App Store Connect.

Overseas transaction has always been a significant part in the process of importing goods from china to malaysia. Blocked credit list Section 175 1. Bhd a GST registered International Procurement Center undertakes procurement and sale.

B input tax on standard rated supplies fee based services - RM 25000. GUIDE ON INPUT TAX CREDIT As at 4 JANUARY 2017. Conditions for claiming input tax.

No input tax credit is available for the following. GST paid on some purchases are however blocked which means that the business cannot claim credit for it when submitting their monthly or quarterly GST returns. Which would be taxable supplies if made in Malaysia.

These are payments made to an individual or company for the ongoing use of. NON ALLOWABLE INPUT TAX. Supply or importation of passenger car including lease of passenger car Club subscription fee recreational or sporting purposes.

Purchase of a passenger motor car. 72A Jalan Prof Diraja Ungku Aziz 46200 Petaling Jaya Selangor. These are standard-rated supplies exempt supplies zero-rated supplies and supplies.

Register your income tax file. A list of No Input Tax Credit. GST Malaysia Section 4 Non-Allowable Input Tax Bad Debts Relief Record Keeping and Offences Penalties.

Supply or importation of passenger car including lease of passenger car Passenger car is defined as a motor car of a kind normally used on public roads which is constructed or adapted for the carriage of not more than nine passengers inclusive of the. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products. Have income that is liable to tax.

Block input tax malaysia list. In Malaysia Goods Services Tax GST falls under 4 categories. There are some Goods Services Tax GST you cant claim even though you have already paid for it when you made your purchases or expenses.

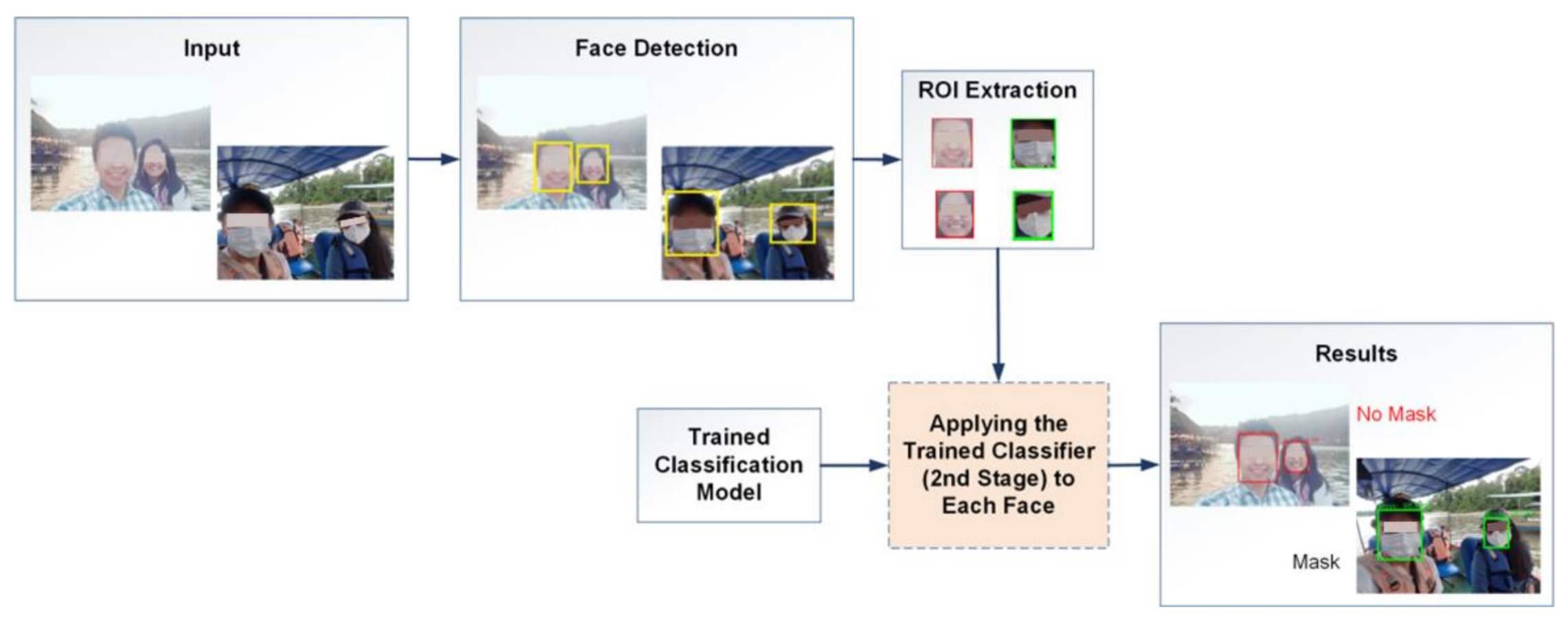

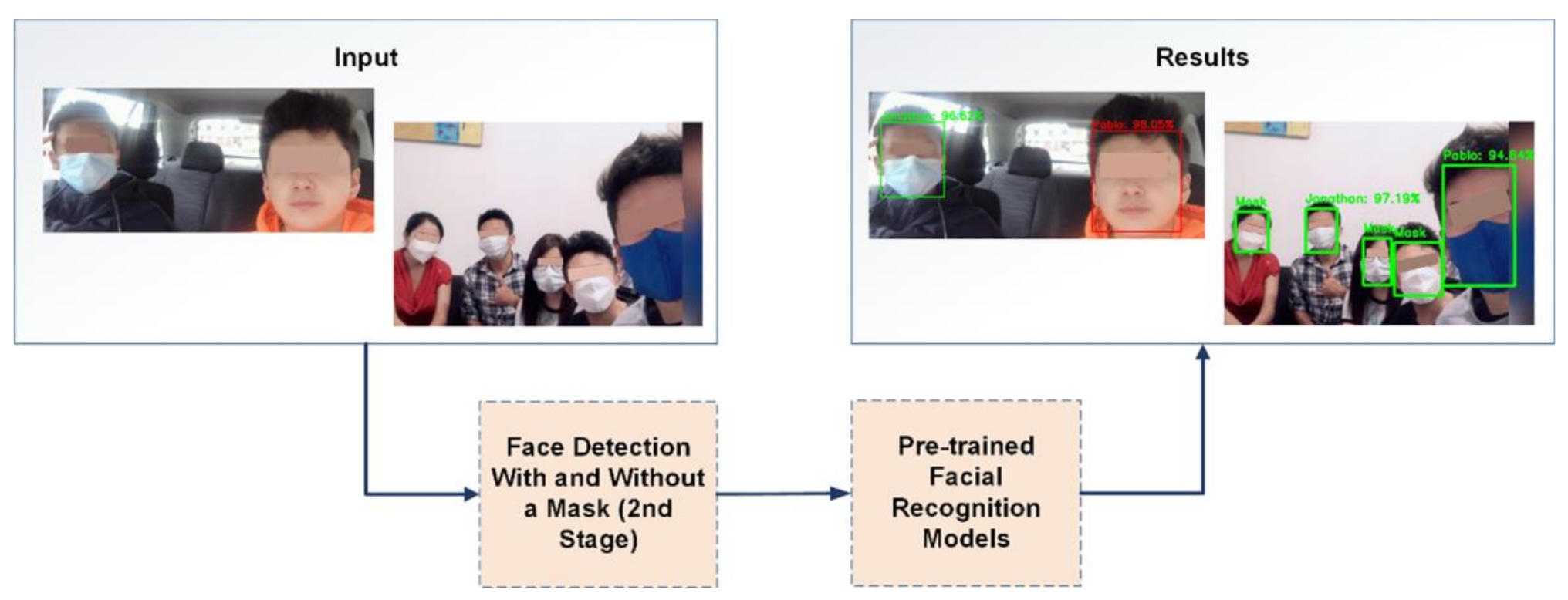

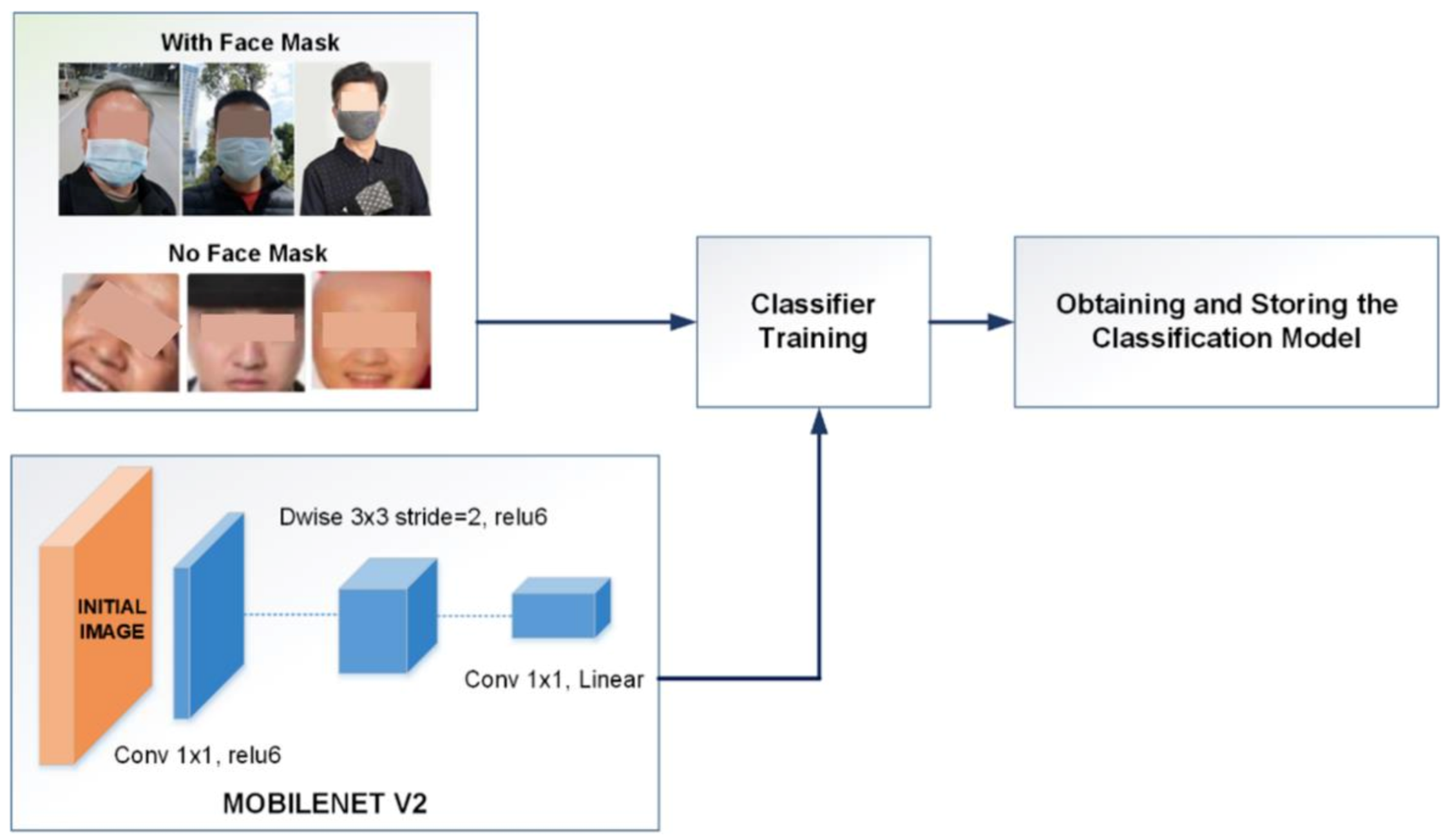

Sustainability Free Full Text Facial Recognition System For People With And Without Face Mask In Times Of The Covid 19 Pandemic Html

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Thinkpad P53 37 Off Workstation Laptops Lenovo Seo Common Title Tpl

Sustainability Free Full Text Facial Recognition System For People With And Without Face Mask In Times Of The Covid 19 Pandemic Html

.png?itok=sp83YYzM)

Stopping State Failure In Afghanistan Crisis Group

Universal Hardware Door Locks Door Hardware The Home Depot

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

How To Use Radeon Settings Advisor Amd

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Sustainability Free Full Text Facial Recognition System For People With And Without Face Mask In Times Of The Covid 19 Pandemic Html

Sustainability Free Full Text Facial Recognition System For People With And Without Face Mask In Times Of The Covid 19 Pandemic Html

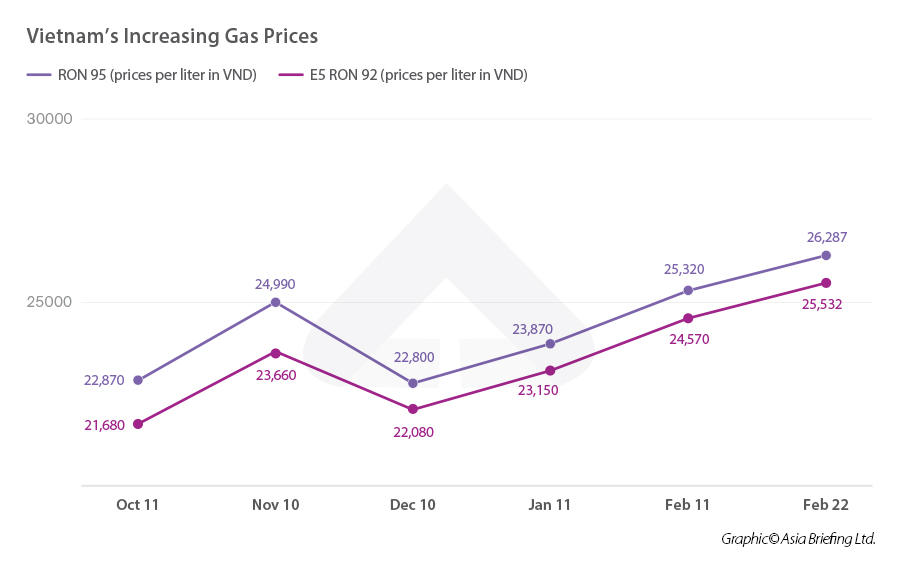

Vietnam S Fuel Prices Surge Government Considers Tax Cuts

Open A Fund Investment Account Online With Ease J P Morgan Asset Management

The Fintech 50 The Complete List 2016

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience